Global Woodworking Machinery Market Trends Amid Geopolitical Turbulence After 2025

Boarke Machine (Po chiao Industry) Co., Ltd.

Hung Chao-Chih, PhD in Management / LL.M.

This article examines global woodworking machinery market trends under the backdrop of international instability by exploring Taiwan’s current industry status and future development, analyzing global market shifts, reviewing the strategic positioning of leading international brands, and assessing how AI is driving production line upgrades to establish digital control as a core element in modern factories.

1. Current Status and Future Development Trends of Taiwan’s Woodworking Machinery Industry

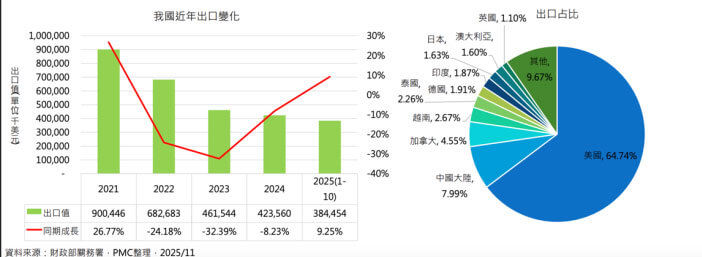

Taiwan’s woodworking machinery industry began to experience a noticeable decline in 2019. However, according to data released by the Taiwan Stock Exchange, the sector saw significant growth in 2020 and 2021, with listed woodworking machinery manufacturers reporting an average increase of over 50%. In fact, 2021 marked a record-high export value of USD 9 billion for the industry. This surge was largely driven by the strong demand for DIY woodworking machinery during the pandemic, as most listed companies specialize in DIY products.

Starting in 2022, exports began to fall sharply, with cumulative declines exceeding 55% between 2021 and 2024. Among Taiwan’s top ten export destinations during this period, all markets experienced substantial contraction, except India, which saw a relatively modest decline of 10.1%. For example, exports to the United States dropped by 55.7%, China by 65.1%, Canada by 44%, Vietnam by 57.1%, Thailand by 42.8%, Germany by 56.5%, Japan by 31.1%, Australia by 30.3%, and the United Kingdom by 71.4%.

Woodworking machinery generally falls into two categories: DIY and industrial grade. Taiwan has three publicly listed companies primarily focused on woodworking machinery—Rexon、Chiu Ting、Chang Type.In addition, there are numerous DIY manufacturers that are not publicly listed, such as OAV、Sanford、King Saw making it difficult to include them in official statistics. Between 2019 and 2021, DIY exports grew dramatically, with an estimated increase of over 50% on average among the three listed companies.

By 2024, Taiwan’s total woodworking machinery export value was approximately USD 420 million (around TWD 12.6 billion). Of this, DIY products accounted for roughly TWD 9.5 billion. This estimate excludes certain revenue streams, such as Rexon’s fitness equipment business, even though woodworking machinery remains one of its core products. Based on these figures, DIY woodworking machinery represents about 75% of the total export value, while industrial-grade machinery accounts for less than 25%.

From 2021 to 2024, overall woodworking machinery exports declined by about 55%. DIY products fell by an average of 45%, and given their 75% share of total exports, industrial-grade machinery likely dropped by more than 75%. While some of these figures are based on industry estimates and may contain minor deviations, they are generally reliable.

The data clearly shows that Taiwan’s woodworking machinery industry has faced a rapid downturn over the past five years. To reverse this trend, the industry must integrate emerging technologies and address evolving user needs—particularly in the industrial-grade segment. Such efforts are essential for Taiwan’s woodworking machinery sector to regain competitiveness and achieve sustainable growth in the future.

2. Global Furniture and Panel Processing Market Shifts

The driving force behind market fluctuations is, unsurprisingly, changes in demand, which in turn push technological upgrades. Current global trends in furniture and panel processing can be summarized into three key points:

(1). “Small-volume, Large-variety” Production Becomes the Norm:

Consumer demand for personalized furniture is surging, forcing factories to develop one-off production capabilities—producing items of varying sizes and specifications without compromising speed.

(2). Shortage of Skilled Labor:

The global manufacturing sector faces a severe labor shortage, particularly for highly experienced craftsmen.

(3). Pressure from Material Costs and Yield Rates:

Forest resources are becoming increasingly scarce and expensive, driving significant fluctuations in panel prices. Additionally, reducing waste and rework to meet future energy-saving and carbon-reduction goals has become critical for cost control.

Under these conditions—small-volume, large-variety production, labor shortages, and material cost pressures—automation is no longer just about reducing manual effort. It is now the only solution to maintain production flexibility, high quality, and high output in the absence of skilled workers.

3. Industry 4.0 and Smart Manufacturing—Beyond Simple Mechanization

The key difference between intelligent automation and traditional automation lies in data integration. However, the required skill sets differ intelligent automation emphasizes software engineering, while traditional automation relies more on mechanical expertise. While traditional automation remains necessary for mass production (which is unlikely to disappear entirely), the rapid growth of customized, small-batch products is inevitable. Therefore, intelligent automation will become mainstream.

The initial steps toward intelligent automation focus on connectivity, digital twins, and real-time monitoring, which are essential for implementing Industry 4.0:

(1). Connectivity:

Machine-to-machine (M2M) communication enables seamless data exchange. For example, cutting dimensions from a panel saw can automatically be transmitted to the edge bander and drilling machine without manual input.

(2). Digital Twin:

Before actual production, the entire process is simulated in software to predict potential collisions or errors, achieving “zero trial-and-error” manufacturing.

(3). Real-time Monitoring:

Managers can track machine utilization (OEE), tool life, and maintenance alerts through dashboards, ensuring operational efficiency and predictive upkeep.

4. International Benchmark Cases

The world’s largest woodworking machinery supplier, HOMAG, offers advanced intelligent processing systems and data integration capabilities. Its equipment features predictive maintenance, precision compensation, and smart scheduling, all of which significantly enhance manufacturing quality and stability. HOMAG also collaborates with international logistics centers to implement automated storage systems and computerized management platforms, improving material control and inventory efficiency for furniture manufacturers while ensuring consistent product quality.

Another industry leader, SCM Group from Italy, is also at the forefront of this trend. Observing its recent trade show highlights (such as the Ligna Show), two key strategies stand out: Flexible Manufacturing Units and Deep Software-Hardware Integration (Maestro Suite).

(1). Flexible Manufacturing Units

SCM has shifted from selling standalone machines to offering integrated solutions:

- Integrated Robotic Arm: Robotic arms handle loading and unloading, connecting cutting, edge-banding, and drilling stations to enable fully automated material flow.

- Loop System: Automated conveyors recirculate panels, allowing a single operator to manage an entire edge-banding line.

(2). Deep Software-Hardware Integration (Maestro Suite)

SCM emphasizes that software is the “brain” of the system. Its platform can generate machining codes directly from CAD/CAM designs and automatically optimize production schedules based on order priorities, minimizing changeover time and maximizing efficiency.

5. How to Drive Production Line Upgrades: Introducing AI and Key Technologies

For small and medium-sized factories or businesses preparing for upgrades, a complete equipment overhaul is often impractical. Instead, improvements should focus on addressing bottlenecks and stabilizing quality. Below are three priority areas where AI and automation can make a significant impact:

(1). Automated Positioning Systems: The Foundation of Precision

(2). Automated Sanding Technology: The Guardian of Quality

(3). Digital Control and Predictive Maintenance

Traditional manual adjustments using rulers or stops are time-consuming and prone to human error.

- Automated positioning systems have become the cornerstone of AI-driven upgrades. In industrial applications, servo motor-driven NC positioning systems are widely adopted.

- AI enhances these systems by storing thousands of machine parameters. For example, when scanning a work order barcode, the stop automatically moves to the precise position (with an error margin of less than 0.1 mm for woodworking processes) and adjusts clamping force based on material characteristics.

- The expected benefit at this stage is reducing changeover time from several minutes to just a few seconds.

In the wood product manufacturing industry, surface sanding is the most tactile process and the hardest role to fill—partly due to high dust levels. Technological solutions include segmented pads and electronic airbag systems.

- Smart control enables machines to detect variations in thickness and shape (including irregular pieces) and automatically adjusts sanding pressure and belt speed.

- The expected outcome is preventing issues such as over-sanding or uneven standing, ensuring consistent surfaces before finishing, and significantly reducing rework rates.

The core of digital control and predictive maintenance lies in data integration and analysis. A centralized control platform using PC-based controllers can replace traditional buttons with visual interfaces.

- AI plays a predictive role by monitoring spindle vibration, temperature, and current anomalies through sensors. Before a breakdown occurs, AI issues alerts such as “Tool wear imminent” or “Bearing requires lubrication,” preventing unexpected downtime and associated production losses.

The above illustrates conceptual approaches to upgrading production lines with AI and key technologies. While woodworking processes are complex and cannot be fully explained in brief, the principles apply broadly.

Smart manufacturing is a challenging and long-term journey that requires phased implementation; otherwise, it becomes a painful starting point for manufacturers.

Step 1: Digitize each workstation and machine, establishing real-time production and capacity monitoring—for example, tracking machine usage to determine when parts need replacement.

Step 2: Integrate data across machines and equipment to align with the manufacturer’s objectives.

Step 3: Connect upstream and downstream information—a critical yet difficult step. This enables real-time scheduling and production progress matching across the supply chain. However, trust between partners remains a major challenge, making this the toughest mile in smart manufacturing.

6. Conclusion: From “Manufacturing” to “Smart Manufacturing”

Competition in the global woodworking machinery market has shifted from hardware performance (who cuts faster) to soft power (who can respond to orders most quickly). The strategies adopted by leading international manufacturers clearly indicate that smart automation is now the standard, not an optional feature.

By introducing automated positioning, intelligent standing, and digital control, companies can not only address labor shortages but also build a modern production line that is flexible, efficient, and fully visualized.

Furthermore, official statistics reveal that global instability—such as escalating conflicts in the Russia-Ukraine war, multiple wars in the Middle East, India-Pakistan tensions, U.S. military pressure on Venezuela, and economic confrontations between China and the U.S., including excessive tariffs and dollar-related disputes—has weakened demand for woodworking machinery. With so many challenges emerging within just two to three years, and no signs of resolution in the near term, investment willingness has declined sharply, making the machinery sector one of the hardest hit.

For woodworking machinery manufacturers, survival and differentiation have become critical issues. Transitioning from traditional manufacturing to smart manufacturing may be an ideal path forward. The above represents my personal perspective for your reference.

Why Partner with Po Chiao?

At Po Chiao Industry, we understand that upgrading to Industry 4.0 is a journey, not just a purchase. We go beyond selling hardware; we provide integrated solutions that combine high-performance Wood CNC Machining Centers with the "soft power" of digital control. Whether you need to optimize a sanding line or integrate a robotic arm for loading, our expertise ensures your factory is resilient against global market shifts.

The era of competing solely on cutting speed is over. The future belongs to those who can respond quickest to orders with minimal waste. Don't let geopolitical turbulence stall your growth. Transform your production capabilities today. Contact Po Chiao for a consultation on the latest smart woodworking solutions.